The Law for Development of New Financial Instruments and Institutions

- دوشنبه, 24 خرداد 1395 14:29

-

3989 بازدید

Article 1:

The following definitions shall apply for the purposes of the terms and phrases used herein:

- Investment Unit means the uniform securities issued by the mutual fund and shall, in return for the investments made by individuals/entities in the fund, be delivered to them recording the specifications of the fund, investor and the amountinvested.

- Free Floating Shares mean a portion of the listed company shares whose holders are typically prepared to offer and sell such shares and do not have the intention of having a say in the company management by retaining such portion ofshares.

- Securities and Exchange Organization means an Organization which has been established by virtue of the Securities Market Act of the I.R.I., ratified on Nov. 22, 2005 and is hereinafter referred to as the"Organization".

- Special Purpose Vehicle (SPV) means one of the financial institutions under the Securities Market Act of the I.R.I. which is authorized to raise funds by issuing securities through the conduct of transactions under the category of Islamiccontracts.

- Mutual Fund means a financial institution which invests the financial resources derived from issuance of investment units in its designated area ofactivity.

- of article (1) of the Securities Market Act of the I.R.I. and the mutual funds under paragraph (1) of article (14) of the "Law for Management and Protection of Housing Construction and Supply" passed on May 15, 2008 and other funds which fall under the category of financial institutions in conformity with the rules of the Securities Market Act of the I.R.I.. Such funds shall become a legal entity as of the registrationdate.

- The duration of the business of such funds shall have to be specified in the articles of association commensurate with the fund's type ofactivity;

- The minimum capital required for the formation of mutual funds shall be the amount of five billion (5,000,000,000) Rials. The Securities and Exchange High Council shall have the authority to increase the minimum capital required for the formation of mutual funds by making allowances for changes in the inflationrate;

- Whether the fund is open-end closed-end as well as the possibility and procedure of transferring the investment unit of funds through issuance and redemption and/or purchase and sale shall have to be stipulated in the fund's articles ofassociation;

- The fund shall, by virtue of the arrangements provided in the articles of association, have at least administering body and one supervisory body acting in the capacity of theinspector/auditor;

- The functions, powers and responsibilities of the said bodies and other bodies such as the guarantor shall be entrusted to the qualified legal entities that accept positions in the fund. The scope of responsibilities and powers of each one of the bodies shall be specified in the articles of association. The administrating body may be appointed from among the eligible naturalpersons.

- The procedures for the fund liquidation at the termination of its business or dissolution shall be subjected to the requirements set forth in the articles of association and the fund manager may also act as liquidator unless he forfeits his eligibility to run the fund. The mutual funds are managed in accordance with the provisions of their articles ofassociation.

- of article (1) of the Securities Market Act of the I.R.I. and the mutual funds under paragraph (1) of article (14) of the "Law for Management and Protection of Housing Construction and Supply" passed on May 15, 2008 and other funds which fall under the category of financial institutions in conformity with the rules of the Securities Market Act of the I.R.I.. Such funds shall become a legal entity as of the registrationdate.

Article 2:

The State Organization for Lands and Deeds Registration shall, merely by virtue of the Organization's license, have to register the funds under paragraphs (19) and

Article 3:

In return for the investment in the funds under article (2), a registered investment unit is issued. The responsibility of investors in such funds shall be confined to the size of their amounts so invested.

Article 4:

Establishment, registration, operations, dissolution and liquidation of the funds under article (2) shall be fulfilled in accordance with the following requirements:

Article 5:

Any dispute arising from investment in the funds under article (2) and their activities and accordingly the disputes among the fund's bodies shall be resolved by the arbitration board as stated in the Securities Market Act of theI.R.I.

Article 6:

The article (143) of the Direct Taxation Act passed on Feb. 22, 1988 and its subsequent amendments, upon deletion of note (1) thereto and retention of notes (2) and (3) as renamed notes (1) and (2) has been modified as follows:

Article 143: Ten percent (10%) of income tax gained from sale of the commodities listed on the commodity exchanges and ten percent (10%) of the income tax of the companies whose shares have been listed for trading on the domestic or foreign exchanges and five percent (5%) of the income tax of the companies whose shares have been listed for trading on the domestic or foreign OTC markets shall be exempted with the approval of the Organization as of the listing year to the year during which they have not been delisted from the listed companies on such exchanges or markets. The companies whose shares are listed for trading on the domestic or foreign exchanges or on the domestic or foreign OTC markets shall enjoy a tax exemption for double the said exemptions provided that they have at least twenty percent (20%) free–floating shares at the end of their fiscal year as confirmed by theOrganization.

Article 7:

The text below along with four notes thereto is added as article (143 bis) to the Direct Taxation Act passed in 1988:

Article 143 (bis): Out of any transfer of shares and preemption rights of companies, whether Iranian or foreign, on the exchanges or on the licensed OTC markets, a flat tax for the amount of half percent (0.5%) of the sales value of shares and preemption rights shall be collected and, in this respect, no more funds shall be claimed as income tax for transfer of shares and preemption rights and value added tax for purchase and sale. The brokers of exchanges and OTC markets shall have to collect the given tax from the transferor during each transfer and pay it into the account which has been assigned by the State Taxation Organization and shall, within ten days from the transfer date, send the relevant receipt along with a list containing the number and amount of shares sold and the preemption rights so transferred to the local Tax AffairsDepartment.

Note 1: All incomes of the mutual fund within the context of this law and all incomes gained from investment in securities under paragraph (24) of article (1) of the Securities Market Act of the I.R.I., ratified in 2005 and the proceeds derived from transfer of such securities or the proceeds earned from issuance and redemption of them shall be exempt from income tax and value-added tax as per the Value-Added Tax Act passed on May 23, 2008 and no tax whatsoever shall be claimed for the transfer, issuance and redemption of the foregoingsecurities.

Note 2: The profit and fees paid or allocated for securities as referred to in note (1) of this article, excluding the dividend and shares of companies, and the profit gained on investment units of funds, on the condition of registering these securities with the Organization, shall be regarded as parts of acceptable expenses for assessment of taxable income of such securities issuer.

Note 3: If any natural person or legal entity domiciled in Iran, who is the shareholder of the company listed on the exchange or OTC markets, sells his shares or preemption rights in foreign stock exchanges or foreign OTC markets, no tax whatsoever shall be levied on and collected in Iran in this respect.

Note 4: The mutual fund shall not be authorized to engage in any other economic activity whatsoever outside the area designated in the licenses issued by the Organization.

Article 8:

In article (104) of the Direct Taxation Act amended on Feb. 16, 2002, the phrase "exchanges, OTC markets and transaction fees and settlement of securities and commodity in exchanges and OTC markets" is added before the word "banks" and the word "contract" precedes the word "transport".

Article 9:

The paragraph (11) of article (12) of the Value-Added Tax Act is amended as follows:

11: Banking and credit services rendered by banks, credit institutions and cooperatives and authorized interest-free loan funds (Gharz Ul- Hassanah– a benevolent loan free from Riba–usury) and transaction services and settlement of securities and commodity in exchanges and OTC markets.

Article 10:

Trading in commodity and securities in the commodity exchanges and all activities carried out by individuals/entities in such exchanges shall be subject to the rules provided in chapter six of the Securities Market Act of the I.R.I. and perpetrators of the offences stated under the said chapter shall be prosecuted in compliance with article (52) of the sameAct.

Article 11:

The SPV shall be exempt from payment of any tax whatsoever and transfer tax and charges and income tax for that category of the assets for which the funds are raised through issue of securities for public offering. The funds raised through issue of securities by such institutions shall be pooled in a special account and any withdrawal from such account shall take place under the supervision and with the approval of the Organization. The regulations governing the activities of the SPVs shall, within three months, be approved by the Securities and Exchange High Council upon the recommendation of the Organization.

Article 12:

The proceeds gained from selling assets to the SPV so as provide financial resources through public offering of securities shall be exempt from tax and no tax and charges whatsoever shall be levied on the transfer of such securities. The depreciation expenses arising from assets value appreciation in the repurchase of the same assets by the seller, in whichever manner, shall not be regarded as parts of the taxdeductable.

Article 13:

The managers of financial institutions, issuers of securities and self-regulatory organizations inclusive of the board members and the managing director shall not have a record of effective absolute criminal conviction and shall hold the required professional qualifications. In the case of ineligibility or their professional disqualification, the appointing authority shall have to reject their appointment to the said positions and/or remove the directors so appointed from their positions. The requirements and criteria for the professional qualifications of the said directors merely in terms of education background and related job experiences and also the method of their disqualification by the Organization shall be provided in a bylaw which shall, upon the recommendation of the Securities and Exchange High Council, be approved by the Council of Ministers (theCabinet).

Article 14:

The issuers of securities, financial institutions and self-regulatory organizations and also the persons who are appointed as their directors shall be deemed to be violators in the case of infringing the laws and regulations relating to the activity of each of them and the Organization shall have the authority to receive cash penalty from the violators from ten million (10,000,000) Rials to one billion (1,000,000,000) Rials and credit such penalty to the treasury account in addition to the disciplinary actions prescribed in articles (7) and (35) of the Securities Market Act of the I.R.I. The bylaw governing the amount of cash penalty in keeping with the act committed shall be drafted upon the joint

recommendations of the Ministry of Economic Affairs and Finance and the Ministry of Justice for the approval of the Council of Ministers (the Cabinet).

Note 1: The sums of cash penalty shall, once every three years, be modified upon the recommendation of the Securities and Exchange High Council and approval of the Council of Ministers in agreement with the Consumer Price Index (CPI) which have officially been published by the Central Bank of I.R.I.

Note 2: The verdicts rendered with regards to penalties shall be binding. Such penalties can be collected through the executive divisions of Registration Department and the Courts' Judgments Enforcement Division. Note 3: The Judiciary may regard the Organization's report on the commission of offences as the report of justice officers where this Organization acts as a complainant and, in pursuance of article (52) of the Securities Market Act of the I.R.I., takes legal action with the competent judicial authorities. The Organization staff shall, in enforcing the court orders as to the said offences, be vested with all those powers and responsibilities which have been expressly stated or stipulated for the officers of justice in the Law of Criminal Procedures. The staff concerned shall be appointed by the ordinance of the prosecutor general and on the recommendation of the Organizationpresident.

Article 15:

If the securities listed on the stock exchange or on the OTC markets and/or the commodity-based securities which are listed on the commodity exchange carry the profit approved, matured or guaranteed, it shall be distributed and paid in a timely manner within the framework of prevailing rules. Where the issuers fail to do so and the securities holders or the Organization lodge a complaint, the matter shall be brought up with the Arbitration Board envisaged in the Securities Market Act of the I.R.I. and the awards passed in this respect shall be enforceable through the Courts' Judgment EnforcementDivision.

Article 16:

Upon the request made by the Organization, all regulated entities such as issuers, financial institutions and self-regulatory organizations shall have to submit records, documents, information and reports requisite for the exercise of the functions and responsibilities legally vested in the Organization. The Organization shall have the power to deliver such information, records, documents and reports to the competent domestic and/or international authorities and institutions within the context of their legal jurisdictions with the approval of the prosecutor general. The directors of the regulated legal entities, in case they fail to comply with the said issues, shall be sentenced to the penalties referred to in article (49) of the Securities Market Act of theI.R.I.

Note 1: Where the provider of information, records and documents declares that the issues presented are regarded as a part of his trade secrets and can not be published, the matter shall be considered at the board meeting of the Organization for decision-making. The decision taken by the Organization board of directors in this respect shall be binding and serve as a basis for further action.

Note 2: The trade secrets are treated to be confidential and in case of their disclosure, the Organization shall be held liable to compensate for the loss and damage sustained by the provider of such documents, records and information providing that the disclosure of trade secrets has taken place by the Organization and in the circumstances not legally allowed to doso.

Note 3: The government, state-owned companies and municipalities shall be excluded from the application of the duties assigned to the issuers of securities under articles (13), (14), (15) and (16) of this law.

Article 17:

The purchase and sale of the commodities listed on the commodity exchanges which are traded in compliance with the rules governing such exchanges by the Ministries, organizations, institutions, governmental and public establishments and executive agencies shall not require the offering of tenders or bids and fulfillment of the related formalities and procedures.

Article 18:

The government shall have to exclude the commodity listed on the exchange from the pricing system.

Note: This article shall not apply to drugs.

This law comprising 18 articles and 7 notes was ratified at the open session of the parliament (Islamic Consultative Assembly) on Wednesday, Dec. 16, 2009.

- دسته: مطالب استاتیک سایت

Securities Market Act of The Islamic Republic of Iran

- دوشنبه, 24 خرداد 1395 14:20

-

4486 بازدید

Chapter One – Definitions and Terms

Article 1- The following definitions shall apply for the purposes of the terms and phrases used in this law:

- 1.Securities and Exchange High Council means a council which is formed under article 3 of the present Law and is hereinafter named theCouncil.

- 2.Securities and Exchange Organization means an Organization which is established under article 5 of the present law and is hereinafter referred to as theOrganization.

- 3.Stock Exchange means an organized and self-regulating market in which the securities are traded by brokers and/or dealers in accordance with the provisions of this law. The Stock Exchange (hereinafter named the Exchange) shall be established and administered in the form of a public joint-stockcompany.

- 4.Arbitration Board means a board which shall be formed under article 37 of thislaw.

- 5.Association means the self-regulatory organizations of brokers, dealers, market-makers, advisors, issuers, investors and other similar associations which are duly registered subject to the regulations approved by the Organization in the form of non-governmental, non- commercial and non-profit entities so as to regulate the relationships among the persons that are involved in the Securities market as per the rules of thislaw.

- 6.Self-Regulatory Organization (SRO) means an organization which is authorized to establish and enforce professional and disciplinary standards and rules in conformity with the present law for the good performance of functions entrusted to it under this law as well as regulating its professional activities and relations among itsmembers.

- 7.Central Securities Depository and Settlement Company means a company which shall provide services relating to registration, depository, transfer of securities ownership, and settlement ofaccounts.

- 8.Over-the-Counter (OTC) Market means a market which is operating in the form of an electronic and non-electronic network where the securities transactions are conducted on the basis ofnegotiations.

- 9.Primary Market means a market where the initial offering and subscription of newly- issued securities is carried out and the proceeds derived from securities offering are transferred to theissuer.

- 10.Secondary market means a market in which the securities are transacted after the initial offering.

- 11.Derivative Market means a market in which the the futures and options contracts based on securities and commodities aretransacted.

- 12.Issuer means a legal entity that issues securities in itsname.

- 13.Broker means a legal entity that engages in securities transactions in the name of other persons and for theiraccount.

- 14.Broker/Dealer means a legal entity that engages in the securities transaction in the name of other persons and for their account and/or in its own name andaccount.

- 15.Market-maker means a broker/dealer that, upon obtaining the required license, engages in trading specified securities with a commitment to increase liquidity, regulate the bid and offer of such securities and limit their price rangefluctuations.

- 16.Investment Advisor means as legal entity that provides advisory services to investors concerningthesecuritiestrading(buyingandselling)onthestrengthofaspecificcontract.

- 17.Portfolio Manager means a legal entity that, under a specific contract, engages in buying and selling securities for investors so as to gainprofit.

- 18.Investment Bank means a company which is operating as an intermediary between the securities issuer and all investors and may get involved in brokerage, dealership, market- making, consulting, portfolio management, subscription, underwriting and similar operations by obtaining a license from theOrganization.

- 19.Pension Fund means an investment fund that provides supplementary benefits for the retirement period of its members by utilizing savings and investmentschemes.

- 20.Mutual Fund means a financial institution whose main activities are investing in securities and their holders shall share in the fund's profit and loss in proportion to their investments.

- 21.Financial Institutions means the financial institutions which are active participants in the securities market including, inter alia, brokers, broker/dealers, market-makers, investment advisors, rating agencies, mutual funds, investment companies, financial data processing companies, investment banks and pensionfunds.

- 22.Parent (Holding) Company means a company that, by investing in an investee company for gaining profits, acquires sufficient right to vote to elect members of the board of directors to exercise control over the company operations and/or plays an effective role in electing the boardmembers.

- 23.Assessor means a financial analyst who makes an assessment/ appraisal of the assets and securities under the presentlaw.

- 24.Securities mean any paper of document which shall bear the transferable financial rights for the owner of an asset and/or its profit. The council shall establish and announce the marketable securities. The concepts of financial instruments and securities have been regarded as equivalent in the text of the presentlaw.

- 25.Issue means the issue of securities for publicoffering.

- 26.Public Offering means the offer of issued securities to the public forsale.

- 27.Private Placement means the direct sale of securities by the issuer to institutional investors.

- 28.Subscription means the process of securities purchase from the issuer and its legal agent and commitment to the payment of full price as per anagreement.

- 29.Underwriting means the guarantee furnished by a third party to take up the securities which have not been sold within the subscriptionperiod.

- 30.Prospectus means a notice which provides information concerning the issuer and the securities eligible for subscription to the generalpublic.

- 31.Registration Statement means a set of forms, information, documents and records which are submitted to the Organization during the course of application for the company registration.

- 32.Inside Information means any type of undisclosed information to the public which is, directly or indirectly, related to the securities, transactions and the issuer thereof and in the case of securities issuance, it shall affect the price and/or the investors’ decisions for trading in the relatedsecurities.

- 33.Portfolio means total financial assets purchased out of the investors’funds.

Chapter Two – Securities Market Bodies

Article 2- In order to protect the investors’ rights, maintain and develop a transparent, fair and efficient market securities and supervise the proper enforcement of this law, the Council and the Organization shall be formed with the composition, function and powers stipulated in the presentlaw.

Article 3- The Council is the highest ranking body of the securities market which shall be charged with the adoption of the macro-policies of such market. The members of the Council shall include:

- Minister of Economic Affairs andFinance

- Minister ofCommerce

- Governor of the Central Bank ofI.R.I

- Heads of the Iranian Chamber of Commerce, Industries and Mines and the Chamber ofCooperatives

- President of the Organization acting as the secretary of the Council and spokesman of theOrganization

- Public prosecutor or hisdeputy

-

- Three financial experts solely from the private sector in consultation with the professional entities in the securities market as recommended by the Minister of Economic Affairs and Finance and approved by the Council ofMinisters.

- One expert solely from the private sector as recommended by the concerned minister and approved by the Council of Ministers of each commodityexchange.

Note-1 The Minister of Economic Affairs and Finance shall be acting as chairman of the Council.

Note 2- The office-term of the members stated in paragraphs 7, 8 and 9 shall run for 5 years and they cannot be elected from among the members of the board of directors and the staff of the Organization.

Note 3- The reelection of the members referred to in paragraphs 7, 8 and 9 of this article shall be possible for a maximum of two terms.

Note 4- The members stated in paragraph 9 shall merely have to attend the meetings held to take decisions on the sameexchange.

Article 4- The functions of the Council are set out as follows:

- to adopt proper measures towards promotion and development of securities market and exercise of supreme control over the application of thislaw;

- to frame the securities market policies in line with the government’s macro-policies and in conformity with the relevant laws andregulations;

- to propose the by-laws for approval by the Council of Ministers as deemed necessary for the enforcement of thislaw;

- to approve new financialinstruments;

- to issue, suspend and revoke the activities of exchanges, OTC markets, Central Securities Depository and Settlement company and investmentbanks;

- to approve the budget and financial statements of theOrganization;

- to monitor and exercise control over the Organization’s operations and handle the complaints againstit;

- to approve the type and amounts of receipts/collectibles by the Organization and exercise supervision overthem;

- to appoint the Organization’s auditor/inspector and establish their fees and remuneration;

- to elect the members of the board of directors of theOrganization;

- to determine the salary, fringe benefits, bonus and remuneration for both the president and members of the board of directors of theOrganization;

- to select members of Arbitration Boars and determine their fees andremuneration;

- to grant permission to the Exchange for offering the securities of its listed companies on the foreignmarkets;

- to grant permission to the Exchange for the listing of foreign securities on the Exchange;

- to grant permission to the Exchange to facilitate transactions by foreign persons/entities on theExchange;

- to address other issues which are, at the discretion of the Council of Ministers, related to the SecuritiesMarket.

- to compile the by-laws required for the enforcement of this law and recommend them to theCouncil;

- to draft the implemental regulations of thislaw;

- to monitor the strict application of this law and pertinentrules;

- to register and issue the license for the public offering of securities and exercise control over the proceduresthereof;

- to request the issuance, suspension and revocation of the establishment license of exchanges and other institutions/entities which fall under the Council’s jurisdiction forapproval;

- to issue, suspend and revoke the establishment licenses of associations and financial institutions subject of this law which do not fall under the direct jurisdiction of the Council;

- to approve the statutes/constitutions of the exchanges, associations and financial institutions subject of the presentlaw;

- to adopt the necessary measures to prevent the occurrence of violations in the securitiesmarket;

- to report such types of violations in the securities market whereby the reporting task has been entrusted to the Organization as per this law to the appropriate authorities and follow up thesame;

- to present the financial statements and periodic reports on the Organization’s performance as well as the status of the securities market to theCouncil;

- to take the appropriate measures and required actions to protect the rights and benefits of investors in the securitiesmarket;

- to provide the required coordination and cooperation with other supervisory boards and policy-makingentities;

- to propose the utilization of new financial instruments in the securities market to the Council;

- to supervise the investments made by foreign natural and legal persons in the

- to draft the budget and propose various revenues and service fees of the Organization for approval by theCouncil;

- to approve the limit of service fees and charges of the Exchange and other financial institutions subject of thislaw;

- to issue the confirmation letter of the Organization prior to the registration of the public joint-stock firms with the Companies Registration Authority and the Organization’s oversight of suchentities;

- to examine and oversee the disclosure of material information by the companies registered with theOrganization;

- to provide cooperation and coordination with accounting authorities, in particular, the Board in charge of Codifying the AuditingStandards;

- to conduct the long-term and macro-research programs towards formulation of future policies of the securitiesmarket;

- to cooperate with and participate in the international institutions and join the related regional and globalorganizations,

- to perform all other affairs entrusted to the Organization by theCouncil.

- the participation certificates issued by the Government, Central Bank and municipalities;

- the participation certificates issued by the banks and financial and credit institutions which are under the supervision of the CentralBank;

- the securities offered in the form of privateplacements;

- the shares of any public joint-stock company whose total shareholders’ equity is less than the figure set by theOrganization,

- the audited annual financialstatements;

- the mid-year financial statements including the audited semiannual and quarter (3 month-period)financials;

- the board of directors' report to the general meetings and the opinion expressed by theauditor,

- any information having a material effect on the securities price and the investors' decision-making.

- any person who, prior to the public offering, takes advantage of the inside information relating to the securities subject of this law being available to him ex- officio which may, in one way or another, be served against the interests of other parties or be served in his own interest or in favor of the persons from whom he is represented under any designation or causes such information to be disclosed or released in the circumstances notpermissible;

- any person who trades in securities by using the insideinformation;

- any person whose actions will typically result in a deceptive appearance of the securities transactions trend or will create false prices or lure persons into securities trading,

- any person who, without observing the provisions of the present law, publishes a notice or a prospectus aimed at public offeringsecurities.

- directors/executives of the company including members of the board of directors, executive board, managing directors and theirdeputies;

- inspectors, advisors/consultants, accountants, auditors and lawyers/ attorneys ofthe company;

- the shareholders who, individually and/or jointly with their dependants hold more than ten (10%) percent of the company shares or such shares are in possession of theirrepresentatives;

- the managing director and board members and the directors concerned or the representatives of the parent (holding) companies who own at least ten (10%) percent of shares or fills at least one seat in the board of directors of the investee company,

-

- any person who, without applying the provisions of this law and under any designation whatsoever, is engaged in the activities such as brokerage, broker/dealership and market-making which shall require obtaining a license and/or introduces himself under any of suchdesignations;

- any person who is obligated under this law to submit all or parts of the information, records and/or material documents to the Organization and/or to the appropriate exchange and refrains from doingso;

- any person who is responsible to compile and gather documents, records, information, registration statement or prospectus and the like for submission to the Organization and accordingly any person who is responsible to examine and comment on or prepare the financial, technical or economic reports or is responsible to certify in any manner such documents and information and violates the provisions of this law in the performance of the assignedduties,

- any person who intentionally and purposefully misuses any information, documents, records or false reports relating to securities in any mannerwhatsoever.

Note- the Council's resolutions shall become enforceable when they have been approved by the Minister of Economic Affairs and Finance.

Article 5- The Organization is a public non-governmental entity with legal and financial independence which shall be funded through the service charges and fees collected from the companies listed on the Exchange as well as other revenues. The funds required to

commence the operations of the Organization shall be raised out of the trust funds of the Stock Exchange Council deposited with the Tehran Stock Exchange Brokers’ Organization.

Note- The statute and administrative structure of the Organization shall, within three months as of the ratification date of this law, be compiled by the Council, and approved by the Council of Ministers.

Article 6- The Organization board of directors shall consist of 5 members who are elected from among the trusted and reputable individuals with financial experiences solely from the non-governmental sector professionals as recommended by the chairman of the Council and approved by the Council. The chairmen of the Council shall issue letters of appointment for the members of the board ofdirectors.

Article 7- The functions and powers of the Organization board of directors are set out as follows:

Exchanges;

Article 8- The office-term of each member of the board of directors shall run for five years and their re-election for the second term shall meet no impediment;

Article 9- The chairman of the Organization board of directors shall be appointed from among the board members on the advice of the members and with the approval of the Council for a period of 30 months.

Note 1- The chairman of the board of directors shall be acting in the capacity of the Organization president and regarded as the highest ranking executive official.

Note 2-The functions and the scope of powers of the Organization president shall be described in the of Organization’s statute.

Article 10- The engagement of the members of the board of directors shall be on a full time basis as an executive member and shall not absolutely be allowed to engage in or assume another responsibility whatsoever in other establishments, agencies and entities whether governmental or non-governmental.

Article 11- In the case of dismissal, death and/or resignation of any member of the board of directors, his substitute shall be elected for the remaining office term within 15 days as the

case may be, subject to the rules specified in article 6. The conditions for dismissal of the board members shall be stipulated in the statute of the Organization.

Article 12- The members of the board of directors shall, prior to assuming their responsibility in the Organization, take an oath at the Council’s meeting so as to perform their legally assigned duties in the best possible manner, take the utmost care and impartiality in the exercise of their functions, ensure that all the resolutions adopted are in the interests of the country and observe the secrecy and confidentiality of the information provided by the Organization and the board of directors. The text of the oath shall be included in the statute of theOrganization.

Article 13- The salaries and benefits of the president and of the board members of the Organization shall be paid out of the budget allocated for this Organization.

Note- The attendance bonus/fees of the Council’s non-governmental members at the meetings shall be fixed and approved by the Council as recommended by the Council chairman and shall be paid out of the Organization budget.

Article 14- From the start of their appointment and at the termination of their office-terms, the members of the board of directors shall have to report the list of their own assets and property and the assets of their wives and dependants to the Council.

Article 15- The auditor/inspector of the Organization shall be chosen by the Council from among the auditing firms being members of the Association of Certified Accountants for the term of one year. The re-election of the auditor/inspector shall be possible for a maximum of twoterms.

Article 16- Any transaction in the securities registered or in the process of registering with the Organization or any direct or indirect activity and engagement in such transactions by the Council members, Organization, directors and partners of the Organization's auditing firm as well as by their dependants shall be forbidden.

Article 17- The members of the Council and the Organization shall, within two years, have to report their economic and financial activities as well as the full-time or part-time jobs that they have had for the past two years to the Head of the Judiciary.

Article 18- The Council members, Organization, directors and partners of the Organization’s auditing firms shall have to refrain from direct or indirect disclosure of confidential information they become aware of in the discharge of their functions even after the expiry of their office-terms. The offender shall be sentenced to the punishments prescribed under article 46 of thislaw.

Article 19- The Organization may, in performance of its legally assigned duties upon the authority of the state public prosecutor, request the furnishing of the required information within the framework of the existing law from all banks, credit institutions, governmental (state) corporations, public and government organizations including the establishments whose names have been mentioned or specified for the applicability of this law as well as natural persons or non-governmental legal entities. All such establishments and persons shall have to present information to the Organization in the specified period of time.

Chapter Three – Primary Market

Article 20- The public offering of securities in the primary market shall be subject to their registration with the Organization pursuant to this law whilst the public offering of securities in any manner whatsoever shall be forbidden without applying the provisions of the rules herein.

Article 21- Registration of securities with the Organization shall provide assurance of the compliance with prevailing rules, the Organization's approvals and information transparency and shall not entail confirmation of any privileges, guarantee of profitability and/or any recommendation and advice as to the companies or the securities-related projects by the Organization. This matter shall be specified in the prospectus.

Article 22- The issuer shall have to submit its application for registering the securities in conjunction with the registration statement and the prospectus so as to obtain the required license for public offering.

Note-The application form of securities registration, the contents of registration statement and prospectus which shall have to be submitted to the Organization and also the procedures of publishing the prospectus and providing coordination between the Companies Registration Authority and the Organization shall be set forth subject to the directive issued by the Organization and approved by theCouncil.

Article 23- The Organization shall have to take action for the approval of the prospectus after it has duly considered the request for securities registration and obtained assurance as to their compliance with the rules in force.

Note 1- The securities public offering shall take place within the period of time specified by the Organization. Such period shall not exceed 30 days. The Organization may extend the subscription period for a maximum of another 30 days at the issuer's request based on the reasonable evidence.

Note 2- The issuer shall, within 15 days after the expiry of the public offering period, notify the Organization of the results of securities sales and distribution in a manner determined

by the Organization. The steps due to be taken by the issuer, where the securities have not been entirely sold, shall be specified in the prospectus.

Note 3- Utilization of the funds so collected shall be authorized when the Organization has confirmed the completion of the public offering process.

Note 4- In the case that the process of public offering has not been completed, the proceeds so collected shall have to be refunded to the investors within 15 days at the latest.

Article 24- If the Organization finds out that the application forms and the annexes thereto received for registration and issuance of the securities are incomplete, it shall, within 15 days, reflect the matter to the issuer and request for an amendment. Where the documentation has been completed, the Organization shall, within 30 days at the latest as of the date of filing the application with this Organization, announce its agreement or disagreement with the securities registration to theissuer.

Article 25- As of the effective date of this law, a license for publication of the prospectus shall be issued by the Companies Registration Authority upon the Organization’s approval in order to have the public joint-stock companies or their capital increase registered.

Article 26- As of the effective date of this law, the functions and powers of the Central Bank of I.R.I under article 4 of the Law on the Issuance of Participation Certificates (Musharakah Sukuk) enacted on September 21, 1997 shall be delegated to the Organization.

Note- The participation certificates which are, subject to this law, exempt from registration with the Organization shall also be excluded from the application of this article.

Article 27- The following securities shall be exempt from registration with the Organization:

Note- The issuer of securities which are exempt from registration shall have to report the specifications and features of the securities and the procedure and requirements of their

distribution and sales to the Organization as per the conditions laid down by this Organization.

Article 28- Establishment of exchanges, OTC markets and financial institutions subject of this law shall require their registration with the Organization. These entities shall be operating under the supervision of the Organization.

Article 29- The professional competency and qualifications of the members of the board of directors and executives, the minimum required capital, subject of the business area as set down in the statute, reporting system and type of special audit reports of financial institutions under this law, shall be approved by the Organization.

Chapter Four – Secondary Market

Article 30- The securities listing on the exchange shall be implemented in accordance with the regulations which shall be approved by the Organization upon the recommendation of each exchange. The exchange shall not be authorized to list the securities which have not been registered with the Organization.

Note- The securities exempted from registration shall be excluded from the provisions of thisarticle.

Article 31- The exchange shall have to prepare the list, number and price of securities traded on business days as per the standards approved by the Organization and shall be publicly announced. Such list shall be deemed as an official instrument and filed in the exchangearchives.

Article 32- The Organization shall, upon identification of emergency conditions, be authorized to issue instruction for suspension and/or halting of transactions on each one of the exchanges for a maximum period of three business days. In the case of continuation of emergency state, such period may be extended by the Council.

Note- The emergency conditions shall be specified in a regulation which shall be approved by the Council as recommended by theOrganization.

Article 33- Commencement of activities by brokers, broker/dealers and market-makers in any manner and under any designation shall be subject to their membership in the appropriate association and compliance with the provisions of this law, regulations and directives.

Note- As long as the Association of Broker/Dealers and Market-makers has not been formed, the functions and duties of such association shall be performed by the Organization. When the number of the association members reaches 11 persons across the

country, it shall be mandatory to form the Association of Broker/Dealers and Market- Makers.

Article 34- The operations and activities of brokers, broker/dealers and market-makers on each exchange shall be subject to their admission into this exchange in accordance with the guidelines recommended by the related exchange and approved by the Organization.

Article 35- The board of directors of the exchange shall investigate the disciplinary violations committed by brokers, broker/dealers, market-makers, issuers and other related members in breach of each provision of this law or appropriate rules in accordance with the prevailing disciplinary regulations. The verdict rendered by the exchange may be appealed with the Organization within one month as of the date of its service. The decision so taken by the Organization shall be absolute and enforceable.

Article 36- The deputies among brokers, market-makers, broker/dealers, investment advisors, issuers and other concerned parties arising from their professional activities shall be investigated by the Arbitration Board if no settlement and compromise can be reached by theassociations.

Article 37- The Arbitration Board shall be composed of three members whereby one member shall be chosen by the Judiciary Head from among the experienced judges and two members shall be appointed by the Council from among the financial and economic professionals as recommended by the Organization so as to investigate the disputes. In addition to their principal representatives, the Head of the Judiciary and the president of the Organization shall, upon the Council's approval, each designate and introduce their alternate members so as to attend the Arbitration Board sessions in case a principal member is absent. The qualifications for the alternate members shall be the same as those for the principalmembers.

Note 1- The representative of the Judiciary shall preside over the Arbitration Board.

Note 2- The office-term of the principal and alternate members shall be two terms at the latest and their reappointment shall be allowed for another two terms at the latest.

Note 3- The Arbitration Board has a secretariat which is based at the premises of the Organization.

Note 4- The budget of the Arbitration Board shall be drafted and paid out of the Organization budget.

Note 5- The awards issued by the Arbitration Board shall be absolute and enforceable and shall be implemented by the Offices and Divisions of the Deeds and Real Estates Registration Department.

Article 38- In the event that the brokers, broker/dealers, market-makers, investment advisors and other similar organizations apply for temporary or permanent withdrawal from their activities, they shall report the matter to the Organization, Association and accordingly to the appropriate exchange and shall deposit their business licenses with the Association. The related guarantees and collaterals shall remain valid until when the status of the transactions conducted and other obligations has been cleared and settled. The latter part of this article shall also apply to brokers, broker/dealers, market-makers, investment advisors and other similar organizations whose memberships have been suspended or revoked in accordance with article 35 of thislaw.

Article 39- The brokers, broker/dealers, market-makers, investment advisors and other similar Organizations shall have to prepare the required reports and submit them to the appropriate authorities subject to the guidelines compiled and notified by the Organization.

Chapter Five - Information Disseminating in the Primary and Secondary Markets

Article 40- The Organization shall arrange a manner that the set of information collected in the process of securities registration shall, within 15 days at the latest, be made available to the public pursuant to the relevant by-laws.

Article 41- The Organization shall have the exchanges, securities issuers, brokers, dealers, market-makers, investment advisors and all organizations active in the capital market release full information on their operations as per the National Auditing and Accounting Standards.

Article 42- The issuer of securities shall have to prepare its financial statements subject to the legal requirements, accounting and financial reporting standards, implemental regulations and directives as communicated by the Organization.

Article 43- The issuer, investment bank, auditor, assessors and the issuer's legal advisors shall be accountable for compensation of damages to the investors that have sustained a loss due to the failure, negligence, violation and/or on the grounds of presenting incomplete and false information in the course of initial offering arising from an act or omission of an act.

Note 1- The parties suffering from a loss under this article may, within one year at the latest after detection of violation, lodge a complaint with the Exchange board of directors or the Arbitration Board providing that not more than three years has lapsed as of the public offering date by the issuer.

Note 2- Only those individuals who have purchased the securities of the issuer subject of this article prior to the detection and announcement of violation shall be entitled to claim damages.

Article 44- If the Organization becomes aware that the issuer has provided false, incomplete, or misleading information in the registration statements or in the prospectus, it may stop the public offering of securities at anystage.

Article 45- Any issuer that has obtained its license for securities issuance from the Organization shall be obligated to submit at least the following items to the Organization in accordance with the directive issued by this Organization:

Chapter Six - Offences and Punishments

Article 46- The following persons shall be sentenced to (discretionary) imprisonment from three months to one year or to cash penalty being equal to two or five times of the profit gained or the non-incurred loss or to both punishments:

Note 1- The following persons shall be regarded as insiders in a company:

Note 2- The persons under Note 1 of this article shall, within 15 days after the conduct of transactions, have to report that portion of their securities trading which is not based on the inside information to the Organization and the Exchange.

Article 47- The persons who present false information or forged documents to the Organization or the Exchange or certify such information and documents and/or use false information and forged documents and records in compiling the reports required under the present law shall be sentenced, as the case may be, to the punishments prescribed in the Islamic Punishment Act ratified on May 27, 1996.

Article 48- The broker, broker/dealer, market-maker, investment advisor who, without permission, disclose the secret/confidential information of the persons whereby they ex- officio become aware of or is made available to them, shall be sentenced to the punishments prescribed in the Islamic Punishment Act ratified on May 27, 1996.

Article 49- The following persons shall be sentenced to (discretionary) imprisonment from one to six months or to cash penalty being equal to one or three times of the profit gained or non-incurred loss or to bothpunishments:

Article 50- The broker, broker/dealer or market-maker that misuses the securities and the funds deposited with him, as required to be kept in a separate account for carrying out transaction, in his own interest or in favor of other parties in contravention of the rules shall be sentenced to the punishments prescribed in article 674 of the Islamic Punishment Act ratified on May 27, 1996.

Article 51- In the case of committing the violations stipulated in this law by legal entities, the punishments so prescribed shall be inflicted, as the case may be, on those natural persons who have been entrusted with the decision-making responsibilities on behalf of the said legalentities.

Article 52- The Organization shall have to collect the evidence and records relating to the violations stipulated in this law and submit them to the competent judicial authorities and shall, as the case may be, follow up the matter as plaintiff/ complainant. If any loss and damage has been incurred by other parties/persons owing to the the foregoing violations, the aggrieved party may submit the statement of claim with the judicial authorities for compensation of the loss and damage so sustained in accordance with the rules in force.

Chapter Seven - Miscellaneous Provisions

Article 53- The broker, broker/dealers, market-makers and other participants in securities market shall, within six months as of the establishment of the Organization, have to take action to establish their Association following the approval of their statute.

Article 54- Not any shareholder, whether natural or legal, shall be allowed to hold directly or indirectly, more than two percent and half (2.5%) of the shares in the Exchange.

Article 55- Not any shareholder, whether natural or legal, shall be allowed to hold, directly or indirectly, more than five percent (%5) of the shares of the Central Securities Depository and Settlement Company.

Article 56- Upon the establishment of the Organization, all records and documents of the Stock Exchange Council subject of the Establishment Act of the Tehran Stock Exchange passed in 1966, shall be transferred to this Organization.

Article 57- The properties and assets of the Brokers' Organization of the existing exchanges including movable and immovable, cash, bank deposits, securities, rights, obligations and other assets shall, after deduction of liabilities and the deposits reserved for the Exchange development, be computed at a committee composed of the organization president, elected representative of the Council and shall, when necessary and appropriate, be apportioned between the joint stock company of the relevant Exchange and the Organization as capital and financial resources at hand respectively. The decisions taken by this committee shall be enforceable upon approval by the Minister of Economic Affairs and Finance.

Note- The employers' records and benefits of the Brokers' Organization of each Exchange shall be redeemed in accordance with the Labor Law legislation.

Article 58- The government shall take necessary measures to activate the commodity exchanges in conformity with the present law and introduce legal guidelines and mechanisms for such purpose.

Article 59- The present law shall fully enter into force four months after the date of its ratification and the Council of Ministers and other authorities referred to herein shall take action in a manner that the administrative and organizational rules and proper executive organs required under this law be established and approved within the said period.

Article 60- Upon the expiry of the periods specified in this law, the Establishment Act of the Stock Exchange approved on May 17, 1966 and all laws and regulations which are in conflict with the present law shall be repealed.

The present law comprising 61 articles, 29 notes was ratified at the opening session of the Parliament (Islamic Consultative Assembly) on Thursday November 22, 2005 and received the assent of the Guardian Council on November 23, 2005.

- دسته: مطالب استاتیک سایت

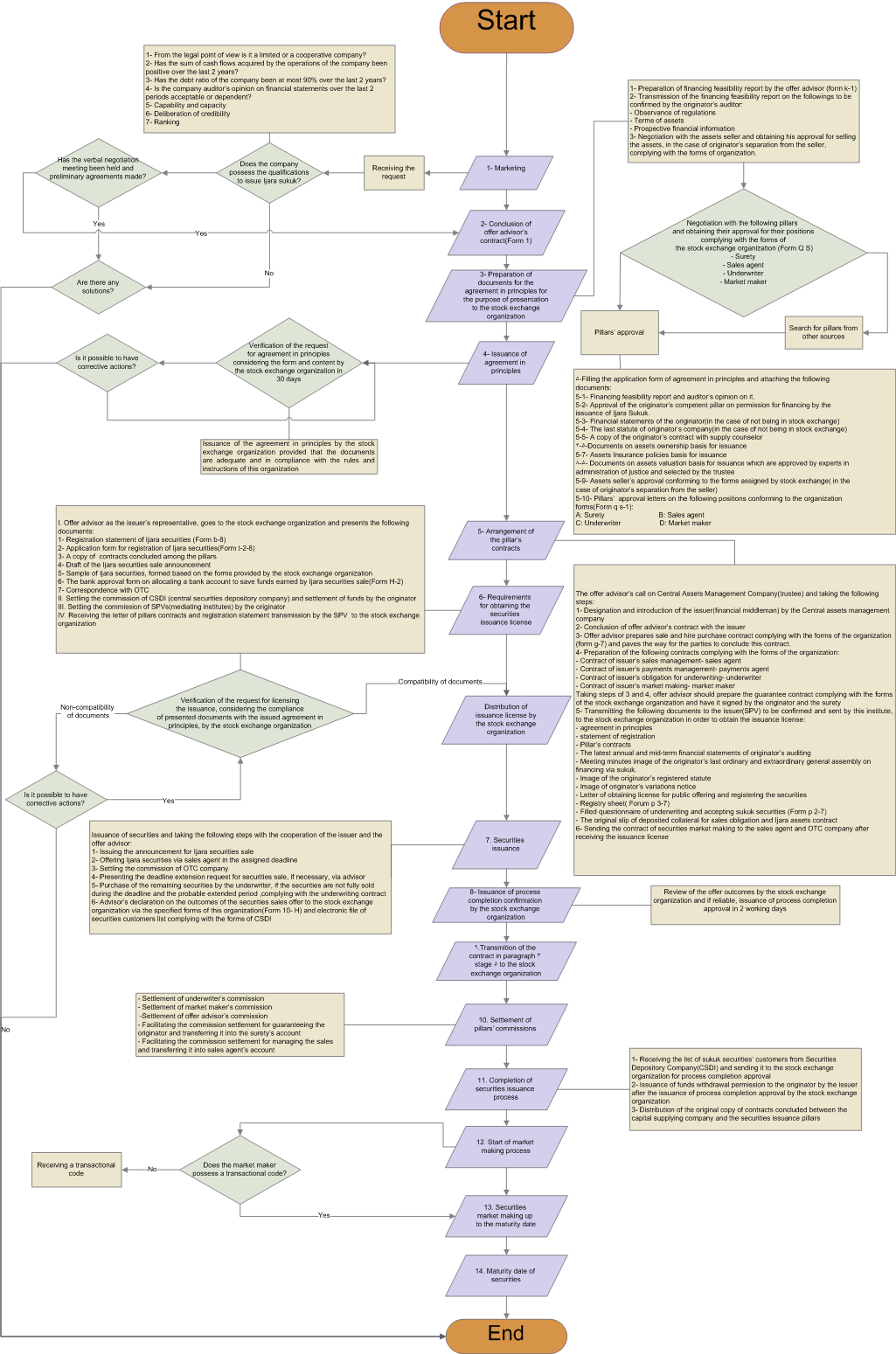

Sukuk issuance flowchart

- دوشنبه, 24 خرداد 1395 13:17

-

9531 بازدید

- دسته: مطالب استاتیک سایت

The Administrative procedure for issuance of Ijarah Sukuk

- دوشنبه, 24 خرداد 1395 13:17

-

8409 بازدید

The originator refers to one of the institutions that have permissions to give consultancy on offerings in order to determine the method of financing. The necessary measures include:

1. Signing a consultancy contract to design the financing method and to offer securities (Form Gh-1)

2. Preparing a justification report of indirect financing through issuance of IjaraSukuk by the consultant based on the forms identified by the organization (Form G-1).

3. Review of the justification report by the originator's auditor so to provide a feedback of the following issues:

Observation of rules and regulations

Conditions of the asset

Future financial information

4. Negotiation with the following entities and obtaining acceptance by them according to the organization's forms (Form Gh S-1):

Guarantor

Sale agent

Underwriter

Market maker

5. Negotiation with the seller of the asset and receiving his acceptance with regard to sale of the asset according to the organization's forms (Form Gh S-2), if the originator and the seller are not the same:

Step two:

The Consultant, as the representative of the originator, refers to SEO to obtain the principal agreement on indirect financing through the issuance of IjaraSukuk. The necessary measures, in order, include:

1. Provision of the following documentation in order to obtain the principal agreement on indirect financing through issuance of IjaraSukuk.

2. The received request will be reviewed by the SEO and if no documentation is missing, will provide a response within 30 days.

3. In case of principal agreement of the SEO, the consultant will take the next measures as the representative of the originator.

Step three:

The consultant refers to Central Asset Management Corporation to determine the issuer and to carry out the necessary measures as follows:

1. Identification and introduction of issuer by the Central Asset Management Corporation based on the principal agreement of SEO,

2. The consultant will prepare the following documentation based on the forms designed by the SEO and will take the necessary steps for the contracts to be signed by both parties.

3. After signing the contracts subject to the above paragraph and conformation of acceptance of the payment agent of the fees related to IjaraSukuk by the CSDI (public joint stock), the consultant will prepare the following contracts based on the forms designed by the SEO and will have them signed by both parties.

4. After steps 2 and 3, the consultant must prepare the contract of guarantee of payment of Ijara amounts (according to Form Gh- 6) and have them signed by both parties.

Step Four:

After obtaining the signatures for the contracts, the consultant, as the representative of the issuer, refers to the SEO to gain the permit of issuance of IajaraSukuk:

1. Providing the documentation required for obtaining the issuance permit to the SEO

2. If the presented documentation accords with the issued principal agreement and the designed forms, SEO will issue the permit of issuance of IjaraSukuk.

Step Five:

After obtaining the permit, the issuer and the consultant embarks on issuing IjaraSukuk within the permitted time frame, observing the related rules and regulation:

1. Offering IjaraSukuk through the sale agent within the specified timeframe

2. Presentation of the request for extending the deadline for selling IjaraSukuk if necessary and through the consultant while observing the rules and regulations,

3. If the entire IjaraSukukare not sold in due time and the possible extended period, the underwriter must pay the underwriting [the period for application of commitment on a daily basis as per the underwriting contract] amount in due time and purchase the remainder of the Sukuk.

4. The outcome of offering and selling the IjaraSukuk need to be reported to the SEO within 15 days, using the specified form (Form H1, and electronic file listing the purchasers of the Sukuk and according to the forms provided by the CSDI) by the consultant.

5. The SEO will investigate the outcome of offering and if accurate, it will issue the confirmation of the end of the process.

6. If offering is not approved, the issuer must, through the sale agent, return the investors' funds within 15 days of the date given by the SEO.

Step Six:

After the issuance of the conformation of the end of process of the SEO, the consultant has to take the following measures:

1. The consultant must have the contract of sale of asset by the seller to the issuer, that is prepared according to the forms designed by the organization, signed by both parties and sent a copy of the original contract to the SEO.

2. The SEO will review the contract in order to make sure it complies with the form, and will announce the result to the consultant.

3. While the steps for transferring the assets to the issuer are taking place, according to the content of the contract and related rules and regulations, the SEO will issue the confirmation of withdrawal of funds from the account of the issuer and payment to the seller.

4. When the assets are transferred to the issuer, the consultant must have the contract of lease of asset by the originator signed by the issuer and originator and send a copy of the original contract to the SEO.

- دسته: مطالب استاتیک سایت

Underwriter

- دوشنبه, 24 خرداد 1395 13:12

-

7834 بازدید

Underwriting refers to the process of purchasing securities from an issuer or their legal representative and being committed to pay for the whole price according to the contract (Exchange Market Act, Article 1, Paragraph 28). The commitment of underwriting is the commitment of a third party for purchasing those securities that are not sold by the underwriting deadline. Based on this definition, it could be said that a private underwriting institution is different from buyers. If the Ijara Sukuk are not sold according to the forecast, the SPV will be obliged to sign a contract with the underwriter so to sell them the rest of the securities. Using this method, the required sources for buying the assets in question will be provided. Therefore, an underwriter is anyone who guarantees the purchase of unissued stocks within a certain period of time (Executive Instruction for Regulating Underwriting Agreements, Article 1, Paragraph F) and is a third party who has guaranteed the purchase of the stocks that are not sold by the underwriting deadline and as per case, has the role of a leader, manager, or coordinator of the underwriting (Executive Instruction for Regulating Underwriting Agreements, Article 1, Paragraph N).

Underwriter is introduced by an originator and if the capital is determined to be sufficient, the underwriter will be selected with the approval of the organization (Instruction for Issuance of Approved Lease securities, 2010: Article 10). Based on the Stock Market Act, Article 1, Paragraph 18, one of the bodies that could act as an underwriter is the financing corporation. Underwriting is the first step of issuance of lease securities, and the next step is public offering. The financing corporation, who can act as the underwriter, could act as the agent of selling (Stock Market Act, Article 1, Paragraph 18). Thus, the financing corporation will the agent of selling at the stage of underwriting Ijara Sukuk and the same corporation will be the underwriter and will be obliged to buy the unsold securities after the public offering and in case not all stocks are sold. "If the assets considered for issuance of Ijara Sukuk could not be divided per certain units, use of underwriter(s) will be obligatory at the stage of offering. Use of underwriters in issuance of Ijara Sukuk for the assets dividable to certain units by the request of the originator and approval of the organization is not obligatory" (Instruction for Issuance of Lease Securities, Article 22).

- دسته: مطالب استاتیک سایت

Market Maker

- دوشنبه, 24 خرداد 1395 13:11

-

7107 بازدید

Another basis of Islamic securities is market maker. Market Maker means a broker/dealer who, after obtaining the required permission, commits to deal in certain securities in a way to increase liquidity and regulate supply and demand for such securities with the aim to limit price fluctuations.

One of the responsibilities of Market Makers is to maintain market Smooth and Regular. Therefore, whenever the balance of stocks assigned to them become disturbing, they react by buying and selling shares in their accounts, help market to adjust supply and demand. So they must have adequate capital. In fact, they play the role of buyer and sellers in security market.

Market maker contains two concepts. In a sense, it operates as market management including different process such as planning, implementation and control variety of different aspects of marketing. In other hand, it means act as a mediator in trading and buying commodity in the name and selling them. In this part we talk about the second meaning.

Market maker institutions make secondary market securities more liquid and when securities market faced with recession, they help markets with dealing securities. They are obliged to buy securities from holders when they need liquidity and want to sell their securities in the secondary market because of absence suitable buyer in recession.

- دسته: مطالب استاتیک سایت

Securities Holder

- دوشنبه, 24 خرداد 1395 13:10

-

6880 بازدید

Securities holder in Islamic Securities is not merely a profit collector, but considering the kind of Securities, he will be engaged directly in financing the Originator. Accordingly the role of Security holder is various considering the kind of the Securities.

Therefore Security holder will act as a partner. It has the role of a lessor who holds a contraction with the Originator (tenant) and the SPV will be the intimidator and receives the rent as profit.

Securities holders which possess any kind of Islamic Securities will be called the Investor, and to do their role as a part of dissemination of Islamic Securities, will choose the SPV as their deputy to convent contractions, administrate the assets and put forward claims and execute them. Therefore in Islamic Securities, Security holder would not have direct influence on dissemination of Islamic Securities, and SPV as its deputy will undertake all roles.

- دسته: مطالب استاتیک سایت

Guarantor

- دوشنبه, 24 خرداد 1395 13:10

-

8186 بازدید

Guarantor is one of the basic factors of Sukuks. Guarantor is act as someone who guarantees the capital and the profit of Securities owners (the first article and item of instruction of Sukuks distribution) and the regulations require its existence. Credit rating will determine the existence or nonexistence of Guarantor. If the corporation has credit rate, according to the 23rd item of instruction of Sukuks distribution, the existence of Guarantor dose not required. Credit rating reveals that whether the Originator has sufficient financial power and enough capital to meet its obligations or not; and guarantees its financial qualification to pay profit and the Securities itself. The conditions of Guarantor and Guarantee according to legal provisions in Islamic Securities:

The Guarantor must be independent of the Originator.

The Guarantor must have sufficient solvency to be a Guarantor.

The Guarantor will be committed to pay the amount that is guaranteed on, only when the Originator refuses to pay it.

The Guarantee of the Guarantor is apart from basic connections between the Guarantor and Originator: Guarantor must undertake anyhow the responsibilities that not met by the Originator, although the Originator ignores its obligations versus the Guarantor.

- دسته: مطالب استاتیک سایت

Agent of Payment

- دوشنبه, 24 خرداد 1395 13:09

-

6993 بازدید

Securities Depository Corporation is the agent of payment for the Islamic securities. This institution signs a contract under the title of "sale agency contract" with the SPV. The agent of payment is entrusted with any payment related to securities to investors or owners of the securities at certain maturity dates. For instance, the payments related to Ijara Sukuk include the returns on Ijara Sukuk and per case, returns on re-investment of some part of the rent and the money earned from sale of assets. Central Securities Depository of Iran (CSDI), after receiving the amounts from issuers, pays the rent (return) and the occasional return, returns on re-investment of part of the rent, and the money earned from sale of assets at certain maturity dates to investors ((Instruction for Issuance of Lease securities, approved in 2010: Article 8). Payment agency contract, the same as Sale agency contract and as the name suggests is granting a sort of power of attorney. Owners of the securities give power of attorney to the SPV, making it the attorney for payment of returns and original securities. This power of attorney brings about the possibility of giving this authority to another entity. Therefore, the SPV gives the authority of payment to the CSDI who will then act as the agent of payment, will obtain the money from the originator and will pay it to the owners of securities. In addition to the return, at the time of the maturity of the securities, the original amount of the securities, which is the result of selling the asset under lease, will be distributed between the owners of securities by the agent of payment and after deduction of the depreciation costs and different fees associated. With regard to keeping the money and distributing it between the owners of securities, agent of payment is considered an intermediary attorney and thus a trustee. The trustee will be held accountable if the damage inflicted on the assets is the result of his fault, otherwise, i.e. if the damage is not the trustee's fault and is the result of a factor beyond his determination, he could be held accountable. In contrast to Sale agency contract, in this contract the intermediary grants power of attorney to the agent of payment on behalf of the securities owners. In other words, the owners have to grant the SPV the authority to grant power of attorney at the beginning. This is due to the fact that the SPV is considered the attorney of the owners with regard to obtaining the returns on securities and its distribution, and holding as well as lease, sale or purchase of the asset under lease. But with regard to payment and distribution of the return, the SPV gives the power of attorney granted by the owners to the agent of payment. The agent of payment can only act within the limitations of its authority and any activity except the permitted ones will be regarded as violation of authority, will be legally-abiding, will make the contract arbitrary, requiring the permission of the SPV.

- دسته: مطالب استاتیک سایت

Sale Agent

- دوشنبه, 24 خرداد 1395 13:09

-

11136 بازدید

Based on Instruction for Issuance of Lease Securities, Paragraph G., the sale agent is a legal person who acts on offering Ijara Sukuk for sale on behalf of the issuer. In fact, the sale agent is the intermediary between the issuer of securities, i.e. the SPV, and the purchasers, i.e. investors. The intervention of the sale agent is in the initial issuance of Ijara Sukuk and it also plays a part in completing the process of public offering in the initial market of lease securities. According to Islamic Republic of Iran's Securities Market Act, Article 1, Paragraph 27, the sale agent can intervene in transfer of Ijara Sukuk when the issuance of securities is in the form of public offering. The sale agent is a legal person that is chosen among the banks, credit or financial institutions that are under the supervision of the Central Bank, finance corporations, Tehran Stock Exchange broker firms, or Iran's OTC (Instruction for Issuance of Lease securities, Article 7). The abovementioned institutions are financial institutions that work in the area of issuance of securities in general. The sale agent needs to be determined by the originator (Instruction for Issuance of Lease securities, 2010: Article 7). The sale agent signs a contract with the SPV in order to transfer contractual securities under "agency of selling securities". As the name suggests, this contract grants some sort of power of attorney with regard to selling securities to the sale agent. The sale agent is the corporation that works as an intermediary between the issuer and investors. In the process of issuing securities, the issuer needs to sell the securities through the sale agent in the initial market. The same agent is the intermediary lawyer with regard to public offering of lease securities. The originator has entrusted the issuance of the securities to the SPV, considering it its lawyer on this matter. The SPV, after the issuance of lease securities, gives the sale agent the power of attorney to sell the securities. In fact, the sale agent is the representative of the SPV and is considered its lawyer only with regard to selling the securities. From the legal point of view, the SPV has given authorization of power of attorney to the sale agent with regard to selling the securities.

The intervention of the sale agent is at the initial stage of issuance of Ijara Sukuk and it also has a role in completing the public offering in the initial market of lease securities. Based on Exchange Market Act, Article 1, Paragraph 27 in the Islamic Republic of Iran on the definition of private offering of securities, the sale agent can intervene in transfer of Ijara Sukuk when the issuance of these securities is in the form of public offering. At this stage, the sale agent needs to pay the sale amount and underwriting amount into the account of the SPV after selling the securities. The sale agent must report the result of selling securities to the Securities and Exchange Organization (SEO) within 15 days. Although the contract of sale agency is between the SPV and the sale agent, the originator has the responsibility of paying the fee of the sale agent and this will justify the originator's presence in the contract.

- دسته: مطالب استاتیک سایت